RRSP – Registered Retirement Savings Plan

RRSP – is a government registered individual retirement program, which is usually started in addition to two government programs: CPP (Canada Pension Plan) and OAS (Old Age Security).

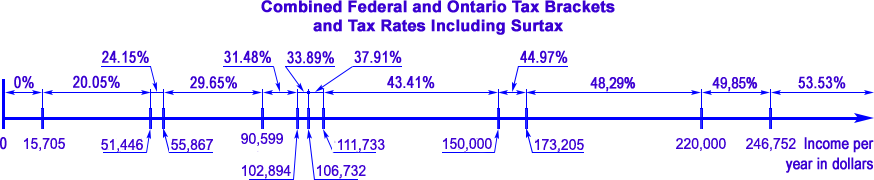

A RRSP is the most popular way to accumulate personal funds for retirement, especially if you are not participating in your employer’s plan. A RRSP is a private, self-directed accumulating plan. Contributions to a RRSP are tax deductible – the contributions reduce taxes, and income or capital gain from the investments inside RRSP are tax-deferred. You will pay taxes when money is withdrawn from your RRSP account. Let me remind you about Canadian tax rates (province of Ontario) to show how beneficial a RRSP is for its owner in 2024.

*Further information about the individual taxes and the current tax rates you can find on website CRA (Canada Revenue Agency).

**On the company’s website www.TaxTips.ca you can see a summary table of taxation.

***You can make an approximate calculation of taxes on the company’s calculator www.TurboTax.ca.

Let us look at some examples. If a person makes $60,000 a year and has a permanent position, his income is taxed every month and he receives a much smaller sum than he earns. At the end of the year the government reviews the amount of money, which was paid by the person and if extra money was paid, returns it to the owner. But still a considerable sum is kept by the government (every case is different). If you earn $60,000 a year and contribute $10,000 into your RRSP, the government will tax you at $50,000 instead of $60,000; the difference in your taxes ($2,965, which is 29.65% from $10,000) will be returned to you by cheque in the mail. So, you’ll have $10,000 on your RRSP account and, besides, $2,965 in cash. The higher the income, the higher the amount of tax return will be. For a $105,000 income, the same $10,000 RRSP investment would yield $4,000 in tax returned (compared to $2,965).

RRSP funds may be invested in different financial and investment programs, such as: Canada Saving Bonds, Guaranteed Investment Certificates (GIC), and segregated funds.

You can open your RRSP account through different financial institutions: banks, credit unions, trusts, investment or insurance companies, brokerages and investment brokers. You can open ordinary RRSP or self-directed RRSP. Self-directed RRSP may contain a wide range of investment programs (such as individual bonds) and allows you to govern your investments directly.

You have a right to invest in to RRSP if you have income.

To invest money in to RRSP you should have employment income, be self-employed or own a business. If you have income you may invest for yourself and for your spouse as well.

Your Yearly Investment Limit.

You may invest in to RRSP up to 18% of your previous year’s earned income to a maximum of $24,270. If your employer makes investments on your group pension plan, your individual RRSP limit is reduced. Revenue Canada will inform you about these reductions through the yearly Notice of Assessment or Notice of Reassessment. If during the year you invest only part of the maximum sum in to RRSP the remainder of this sum can be transferred to the nest year.

If you didn’t invest money in to RRSP in the current year, government allows you to do this during the first 60 days of the nest year (January, February). People even borrow money under interest, if they don’t have any today to put into RRSP.

Now you understand why all the banks are dazzling with advertisements like “Borrow money from us for RRSP”. There are 5 seasons in Canada: winter, spring, summer, fall and RRSP. I would like you to see calculations, showing why it is beneficial even to borrow money sometimes and invest in RRSP. Let us suppose that you wanted to invest $10,000 in your RRSP in February, but you spent your money for something else. You may borrow money for RRSP under 4% of interest. If you borrow $10,000 for a year, at the end of the year you will have to pay back $10,000 plus interest. Of course, we do not want to pay interest, but we are going to get tax break cash $3,100 today. To decrease the interest debt we can return part of our debt immediately, after receiving a cheque for $3,100, and the rest of the money hay back in monthly instalments. Thus, we will be able to reduce interest payments. Do not forget, that your $10,000 also works for you and brings you interest, maybe even better than 4%.

What Income to Expect.

The amount of income, you may expect from your RRSP, depends on investment and on investment income, which is accumulated in your plan by the time of your retirement.

Mainly on: how much did you accumulate, time, during which your investment earned interest, how successfully you invested your money.

The goal of RRSP – to provide you with retirement income. However, as soon as you take off money from your RRSP account, you pay taxes on that sum. Financial institution, which has your RRSP account, will take applicable taxes. If you take off $5,000 the taxes will be 10%, up to $15,000 – 20%, more than $15,000 – 30%. Of course, the taxes will be reassessed.

The Home Buyers’ Plan (HPB) and The Lifelong Learning Plan (LLP).

These two programs allows you to withdraw money from your RRSP without immediate tax deductions. Withdrawing money using LLP is allowed only to cover educational expenses for the RRSP account holder himself/herself, and not his relatives or dependents. HPB allows withdrawing up to $35,000 to make the down payment for your first real estate property, such a house. After taking the money out using these two plans, you must return the amount withdrawn in 10 (for LLP) or 15 (for HPB) years. Every year you will be notified about the amount of the required payment. Any missed payments will be counted as your income and taxes will be deducted.

To see the benefits of RRSP when purchasing your first real estate property, consider an example. Suppose, your goal is to save $20,000 in 2 years for the down payment. If you use bank accounts for holding your savings, you will only have the $20,000 that you contributed. However, by using RRSP, you will get $20000 you invested plus $6,200 as a result of tax reductions, which increased the saved amount from $20,000 to $26,200 (e.g. for income between $37,885 до $75,769, $20,000 x 0.3100% = $6,200). Of course, when buying a house, extra $6,200 will prove useful.

Transferring your RRSP on Retirement.

You can contribute to your RRSP right until the end of the year in which you turn 71. By the end of this year, you must transfer your RRSP into Registered Retirement Income Fund (RRIF), buy an annuity (and, thus, ensure your pension savings), or withdraw the entire amount. Withdrawing all your savings is the least attractive option, since about half of them will be deducted as taxes. With RRIF, you must withdraw a fixed minimal amount each year, and will have to pay taxes on that amount. Of course, the tax deductions will be smaller than in the case of withdrawing the entire sum, which is the benefit of RRIF. In addition, any income earned on your savings within RRIF is not subject to taxes. Note that any sums withdrawn from RRSP or RRIF are added to your income and may affect you OAS (Old Age Security) benefits.

What should I do now?

First, determine you deduction limit, which is shown on your Notice of Assessment or Notice of Reassessment. This documents are mailed to you each year by CRA after you file your income tax declaration. If you have not received this document, please contact CRA: T.I.P.S. 1-800-267-6999.

List all the RRSP contributions made so far and keep all the account numbers.

Set your goals. Determine what portion of your income you would like to contribute and choose a plan that will allow you to achieve your goal.

I hope that you agree that the earlier you start to make contributions the more benefits they will yield.

Looking forward to your calls.